tax on unrealized gains uk

Bidens fiscal 2023 budget request released Monday would impose a 20 minimum tax on the unrealized capital gains for households worth at least 100 million. However it was my understanding that unrealised gains of this nature should be stripped.

Other Comprehensive Income Overview Examples How It Works

Unrealized gains are not taxed by the IRS.

. He estimated that taxpayers subject to our proposal have unrealized gains totaling about 75 trillion in 2022. But one aspect of his proposal a minimum 20 tax on the unrealized gains of US. Unrealised gains on investment shares - is Corp tax chargeable.

This reflects the 10k investment and the 5k unrealised gain. Below are one economists estimates of what the top 10 wealthiest. President Joe Biden will propose a minimum 20 tax rate that would hit both the income and unrealized capital gains of US.

According to the ATAD Directive the tax levied on unrealized capital gains is intended to ensure that if a taxpayer moves assets or its tax residence out of the tax. The accounts will also show unrealised gains or losses where such assets or liabilities exist at the end of the period of account and are retranslated into sterling at the closing rate see BIM39510. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value.

There will be a corresponding debtor relationship where the debtor to the creditor loan relationship is within the charge to UK corporation tax and is required to bring into. This means you dont have to report them on your annual tax return. When the wealthiest families incur income taxes on capital gains they pay a top 238 federal tax rate on the transaction lower than the top 37 rate on income like wages.

The CGT is only taxed on the profit and gained amount not on the total revenue of the asset. A UK resident company is taxed on its worldwide total profits. The proposed 20 tax on unrealized gains was put forward by the US Department of Treasurys 2023 Income Proposition.

Limited company made 100k of investments during its company year - all investments in publicly traded shares not funds or unit trusts they bought shares directly in companies. If these households realize 6 trillion of their 75 trillion of. In simple terms a foreign exchange gain or loss is realised when a transaction is finalised and unrealised whilst it is still in progress.

There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings. Lets look at an example and for ease lets. It can potentially become a penalty for.

Again under Bidens plan they would be required to pay a minimum 20 income tax on this appreciation. Total profits are the aggregate of i. From a tax point of view the UK was long known for being a favourable place for real estate investments by non-UK tax residents.

But times are changing. March 26 2022 229 PM PDT. This means that tax liabilities can arise.

The basic tax rule in the UK is that foreign exchange movements on loans and derivatives are taxabletax deductible as they accrue. Taxes are paid only on realized gains. I understand there has to be a fair value adjustment in the PL to refelct the increased value of the investment to 15k.

Last reviewed - 30 December 2021. For example you bought an asset worth 10000 and sold it at 14000 the amount of gain you. Taxes on unrealised Gains Losses Post by pawncob Tue Jul 22 2014 1024 pm You show the shares at the current market value and show a notional profitloss on the PL.

Under the proposed Billionaire. Its the gain you make thats taxed not the. Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022.

Corporate - Income determination. Households worth 100 million or more is drawing skepticism from tax experts. The investor can plan when to.

716 pm EST. Thus by knowing the Unrealized Gain the Company can forecast the amount of tax to be paid if they sell the securities. Capital gains are only taxed if they are realized which means.

For example if you were ahead of the curve and bought bitcoin for 100 and. Under FRS102 we need to.

Crypto Tax Unrealized Gains Explained Koinly

Income Tax Accounting Hot Topics Year End 2020 Bdo

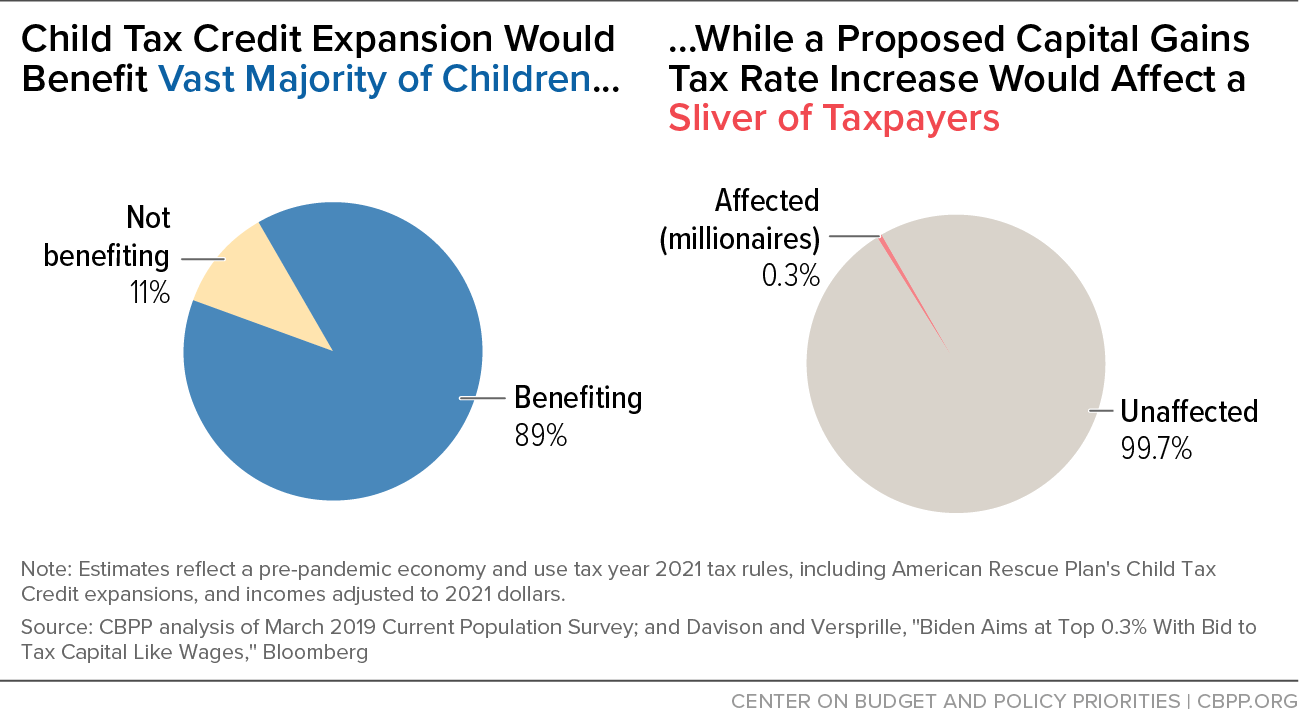

On Tax Day 9 Charts On The System S Inequities And Plans To Address Them Center On Budget And Policy Priorities

How To Tax Capital Without Hurting Investment The Economist

12 Ways To Beat Capital Gains Tax In The Age Of Trump

On Tax Day 9 Charts On The System S Inequities And Plans To Address Them Center On Budget And Policy Priorities

Tax Filing Season Highlights Need To Reform Tax System Rebuild Irs Center On Budget And Policy Priorities

Crypto Tax Unrealized Gains Explained Koinly

Crypto Tax Unrealized Gains Explained Koinly

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

Winter Is Coming Plan Ahead For Potential Tax Changes Context Ab

Crypto Tax Unrealized Gains Explained Koinly

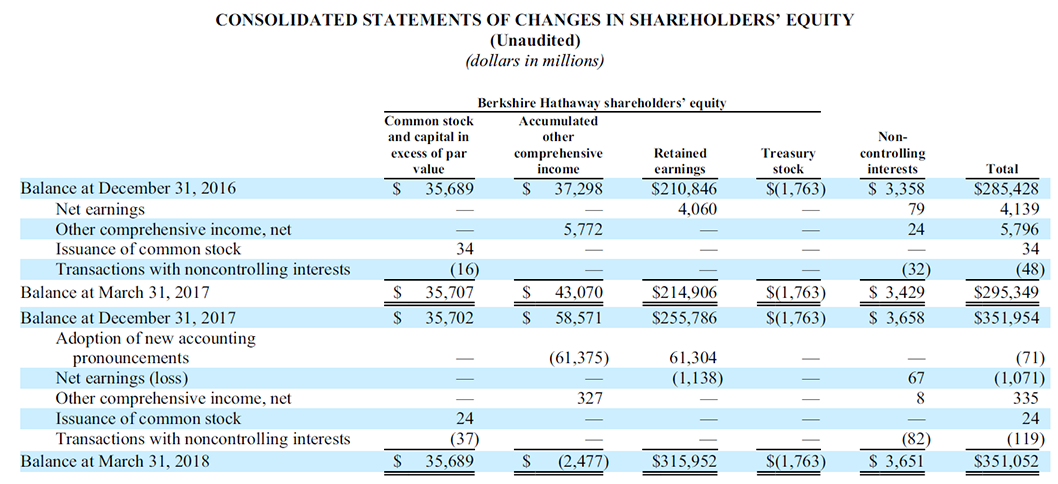

Berkshire S Bottom Line More Relevant Than Ever Before Cfa Institute Market Integrity Insights

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

Crypto Tax Unrealized Gains Explained Koinly

Derivatives And Hedging Accounting Vs Taxation

Unintended Consequences Of Taxing Unrealized Capital Gains Investing Com

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)